Shocking economics

A shock pushes economies out of a state of equilibrium. Modern macroeconomics are still based on the assumption of equilibria. That makes them fail when dealing with economies in times of crises. Image: Artisticco LLC|123rf

A novel theory derived from classical physics allows scientists to predict how economies worldwide respond to major disturbances such as the 2008 Great Recession or Trump tariffs, effectively making their effects computable for the first time. The research, carried out by the Complexity Science Hub Vienna (CSH), adds to current economic models in several ways:

Calculating resilience

"First, we can determine the resilience of an economy," says Peter Klimek, first author of the paper. Each country has different industries, and depends on various imports and exports. "We see all these interdependencies in newly available data sets. From these data we can calculate how susceptible a country and its different production sectors are to disturbances."

The scientists see, for instance, which parts of an economy are particularly vulnerable to a shock, such as a trade war.

Modelling outputs

"We can further quantify how much a shock in one corner of the world affects the production of a given sector far across the globe," says co-author Stefan Thurner. Modelling responses to shocks helps answer questions like why it took economies so long to recover from the 2008 recession. "A shock does not evaporate," explains Klimek. Just like a rock that is thrown into a still pond, a shock produces waves. "The shock waves will run through the whole system, following each of its interdependent connections." The researchers found that it typically takes six to ten years before all sectors of an economy have fully digested a shock.

Testable predictions

Another line of progress resulting from the new method is that testable predictions can be made. The authors took the input-output data of 56 industrial sectors in 43 OECD countries from 2000 to 2014. With this large dataset they tested the accuracy of different economic projections that were dealing with the aftermaths of 2008. "Our method clearly outperformed all standard econometric forecasting methods - most of them substantially," the authors state.

They also estimated the effects of Donald Trump's new tariffs on EU steel and aluminium, imposed in June, 2018. The model finds winners and losers. In Germany, for instance, the output of the automotive industry increases, as do legal activities or wholesale trade. On the other hand, electricity production, warehousing or land transport show a decline.

"Interestingly, the production output in most of the EU countries rises so much that it can partly compensate the losses due to the tariffs," says Thurner. As soon as statistics for 2018 and 2019 are available, the team will test its prediction with real-world data. "Our vision is to eventually be able to calculate global effects of all kinds of shock scenarios that can happen anywhere," the complexity scientist adds.

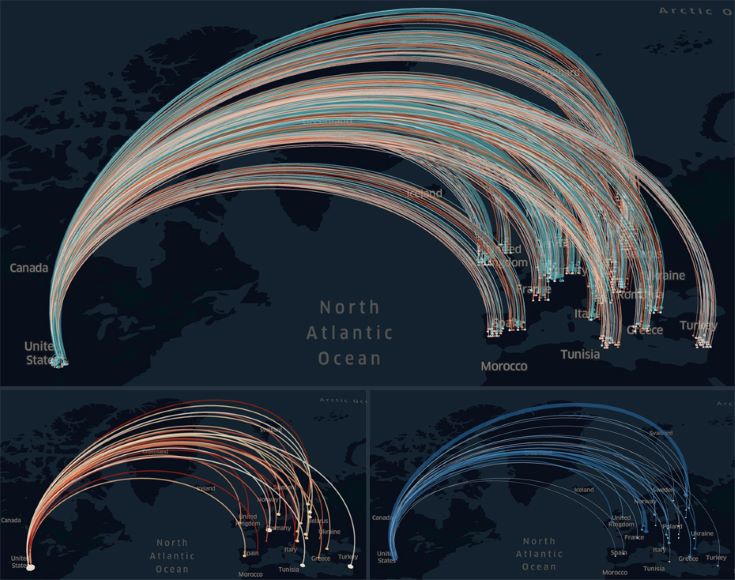

Each arc shows the impact of Trump tariffs on one economic sector in Europe. The blue lines show countries and sectors that gain output from the shock; red lines indicate a decreased output. The darker the lines, the bigger the effects are. Bottom left: The electricity sector shows a decrease in output consistently through all countries due to less energy being required in the EU steel and aluminium manufacturing sector. Bottom right: The manufacturers of automotive vehicles profit from the tariffs. The reduced demand for European steel and aluminium in the US increases the supply of these metals in Europe. This leads to positive effects for sectors that require them. Credit: CSH/Johannes Sorger (software: kepler.gl)

A concept from physics

The concept for the new model is inspired by classical physics: Linear response theory (LRT) explains, for example, how electric or magnetic substances react to strong electrical or magnetic fields. This is known as susceptibility. It can be measured with special devices, but also be mathematically derived from properties of the material. "We show that LRT applies just as well to input-output economics," says Klimek. "Instead of material properties, we use economic networks; instead of electrical resistance, we determine the susceptibility of economies, their response to shocks."

Visualising economies

To make it intuitively understandable how economies work, scientists at the CSH employ an interactive visualisation tool. It will be constantly fed with new data until the final version represents the whole world economy.

The tool visualises the various dependencies of countries and production sectors. "Users can change all kinds of parameters and immediately see the effects across countries and sectors," says Thurner. A preliminary version, showing Trump tariff effects on Europe, can be seen here.

For more information, visit the CSH website.